TIN ID | What are the Requirements, Verifications in Philippines

The Taxpayer Identification Number (TIN) is an essential component of the legal and financial system in the Philippines. Whether you are a person, a company owner, or a foreign investor, complying with tax laws and gaining access to different government services depends on having a TIN ID.

This blog will guide you through everything you need to know about the TIN ID, from its importance to the application process.

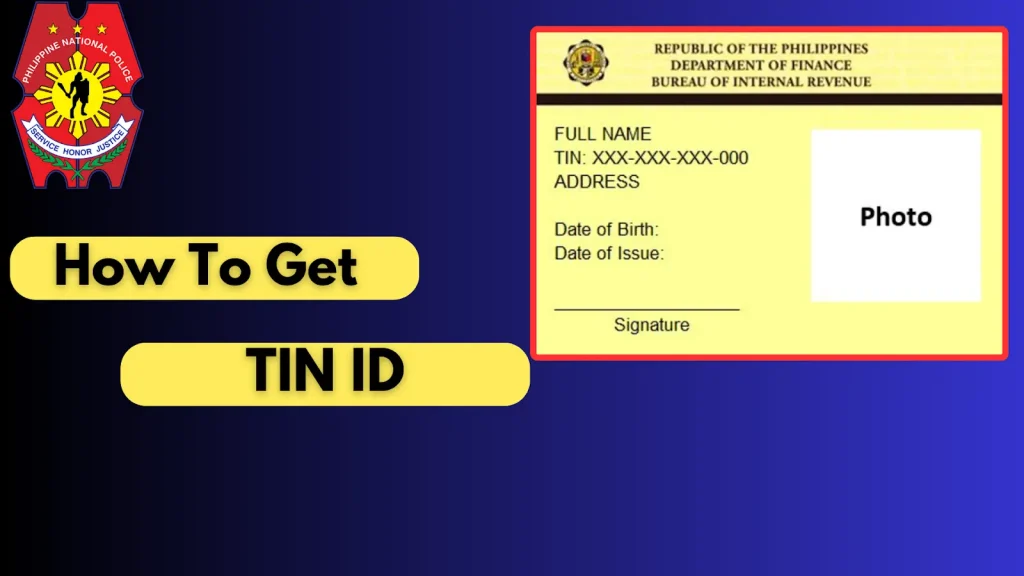

What is a TIN ID?

A Taxpayer Identification Number (TIN) is a specific identity, issued by the Bureau of Internal Revenue (BIR) in the Philippines. It is a crucial instrument for controlling tax obligations and ensuring tax law compliance. Initially meant to simplify tax collecting and prevent fraud, the TIN enables the government to track and verify people and companies included in the tax system.

Why is TIN ID Important?

The tax identification number ID is not only a serial number, it is an essential part of your financial identification in the Philippines. Here why it important:

Who Needs a TIN ID?

1. Individuals

Every resident foreign nationals and Filipino citizen must have a TIN. This includes those who are employed, self-employed, or involved in any kind of commercial activity.

2. Business Owners and Self-Employed Professionals

Whether you own a company or work as a freelancer, paying tax returns and doing business operations depend on a TIN.

3. Foreigners with Business Interests in the Philippines

Foreigners intending to do business or investments in the Philippines have to get a TIN for tax purposes.

Types of TIN IDs

There are three major types of tax identification number ID which are described below:

- Regular TIN ID: For individual taxpayers (for employed, self-employed, or those engaged in business activities).

- TIN ID for Businesses: For corporate entities and self-employed individuals.

- TIN ID for Government Employees: Special TIN IDs for those employed by the government.

How to Get a TIN ID

Here’s step-by-step guide to follow to get a TIN ID:

For Individuals

- Filipino citizens or resident foreign nationals

- Age 18 and above

- Birth certificate or valid ID

- Proof of address

- Recent 2×2 photo

- Visit the BIR Office: Go to the nearest BIR Revenue District Office (RDO).

- Fill Out BIR Form 1901: Complete the application form for new individuals.

- Submit Documents: Provide the required documents to the BIR officer.

- Receive TIN ID: After processing, you will be issued your TIN ID.

For Business Owners

- Proof of business registration

- Identification documents

- Business name registration

- Articles of incorporation (if applicable)

- Prepare Documents: Gather all necessary business and personal documents.

- Submit BIR Form 1903: Complete the application form for businesses.

- Visit the BIR Office: Submit your application and documents.

- Obtain Tax Identification Number ID: Your business TIN will be issued upon approval.

For Foreigners

- Passport

- Visa or work permit

- Proof of business registration (if applicable)

- Gather Required Documents: Ensure all documents are in proper arrangement.

- Complete Application Form: Fill out the appropriate BIR form.

- Submit at BIR Office: Present your documents at the BIR office.

- Receive Tax Identification Number ID: Your TIN ID will be issued after processing.

What to Do If You Lose Your TIN ID

TIN ID Verification:

- Contact the BIR office immediately if your TIN ID is lost or stolen.

Steps to Get a Replacement:

- Submit a Report: Report the loss to the BIR.

- Submit a Replacement Request: Complete the required form for a new TIN ID.

- Pay Associated Fees: There may be minimal fee for replacement.

Role of TIN ID in Government Services

A tax identification number is essential for accessing various government services. It is used for:

TIN ID Fees

Typically, there is no application fee for obtaining a TIN ID for individuals but a registration fee of PHP 500 is required. The process of applying for a TIN ID is generally free for Filipino citizens and residents of foreign nationals.

TIN ID and Financial Transactions

Your tax identification number ID is crucial when dealing with financial institutions. It is required for:

FAQs

Conclusion

Legal and financial processes in the Philippines depend fundamentally on the tax identification number ID. It is essential for compliance and access to various services for both individuals and company owners to understand and maintain their tax identification number. Follow the guidelines provided in this blog to ensure you manage your TIN ID effectively.