Tax Clearance Certificate in Philippines 2025

A Tax Clearance Certificate (TCC) is a crucial record in the Philippines certifying a person or entity’s tax obligation compliance to the Bureau of Internal Revenue (BIR). It provides proof of tax regularity, usually needed for several different purposes, including business registration, loan securing, and government application participation.

In this blog, we’ll explore the complexities involved in obtaining a tax clearance certificate in the philippines.

What is a Tax Clearance Certificate?

In the Philippines, a Tax Clearance is an official document issued by the Bureau of Internal Revenue (BIR). One of the conditions for establishing a new or continuing contract with the government is a TCC proving your compliance to tax laws and timely payment of taxes.

In another way, it indicates that the individual has no unpaid taxes.

Types of Tax Clearance Certificates

There are three different types of tax clearance certificate:

BIR Tax Clearance for Business:

This is commonly required for businesses and covers various taxes such as VAT, income tax, and local business taxes.

BIR Tax Clearance for Individuals:

This is often needed for individuals seeking to prove their tax compliance for loans or other financial transactions.

BIR Tax Clearance for Estate:

Required when settling an estate, ensuring that all estate taxes have been paid.

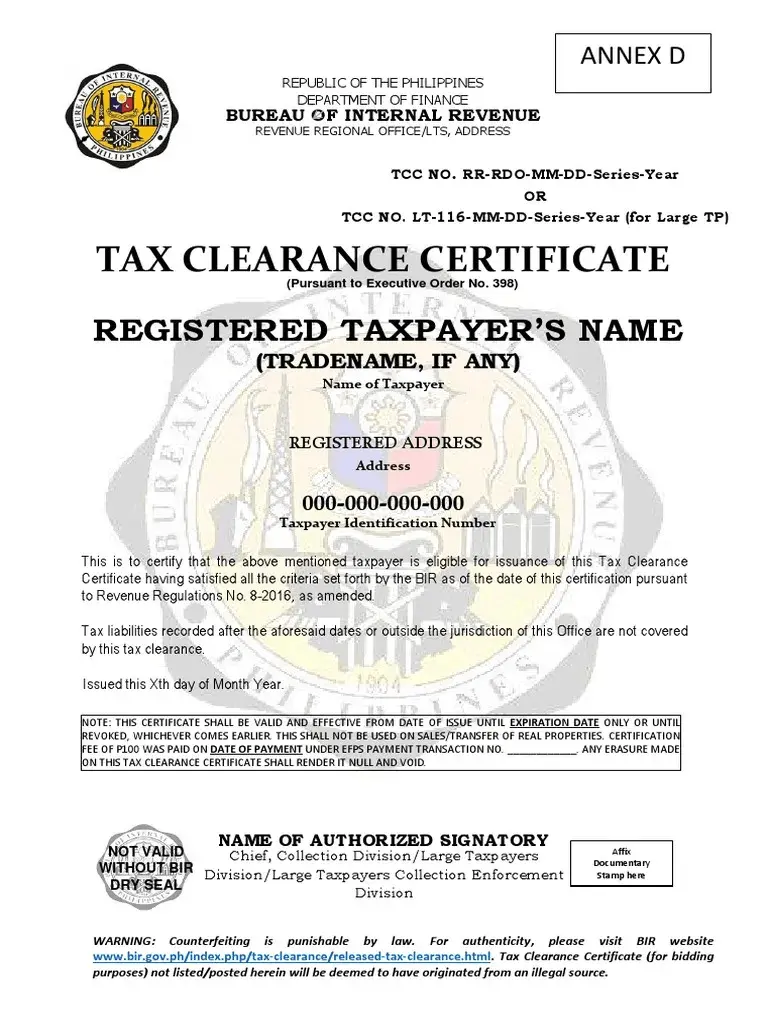

Tax Clearance Certificate Sample

Required Documents for Tax Clearance Certificate

Getting a Tax Clearance Certificate in the Philippines usually requires submitting the Bureau of Internal Revenue (BIR) certain documentation. Typically, the clearance is required for business closure, loan application, or other purposes. However, the general documents required are:

Eligibility Criteria for Tax Clearance Certificate

The eligibility criteria for obtaining a tax clearance certificate depend on the purpose of clearance. However, the general criteria include:

For Business Closure:

For Government Contracts/Projects:

For Loans or Financial Transactions:

Where to Get Tax Clearance Certificate Philippines

Tax clearance certificates and mtc clearance are issued by the Bureau of Internal Revenue (BIR) in the Philippines. You can submit all the required documentation for it by visiting the regional or district office of the BIR in your area. But make sure you have all the required documents, including completed forms and evidence of tax payments. Processing fees may apply to some applications.

How to apply online for a tax clearance certificate?

Before applying for a Tax Clearance Certificate, ensure that:

Gather Required Documents

Depending on your status (individual or business), the documents may vary but generally include:

Apply for a Tax Clearance Certificate

For Individuals:

For Businesses:

- Submit an Application: Business owners must complete the BIR Form 1905 (Application for Registration Information Update) or other relevant forms.

- Submit Supporting Documents: Include documents like the latest ITR, proof of payment, and other required records.

- BIR Verification: The BIR will review your documents and verify your tax status.

Pay the Processing Fee

There may be a minimal processing fee for issuing a TCC. The exact amount can vary, so confirm with the BIR office or check their official website.

Receive the Certificate

Once your application is processed and approved, you will receive your Tax Certificate. This document can usually be picked up from the BIR office or received online if available.

Tax Clearance Certificate Processing Time

Typically, it takes around 3 to 5 working days from the date of submission of the complete application and requirements. However, this timeframe can vary based on the specific Bureau of Internal Revenue (BIR) office and the complexity of your case.

Tax Clearance Certificate Validity

Normally, a TCC is valid for a year after it is issued. However, as the validity criteria might differ, the certificate may need to be renewed more regularly for certain uses, such as submitting applications for government contracts.

Why is a Tax Clearance Certificate Important?

FAQs

Conclusion

Corporate executives both personally and professionally working in the Philippines need to get a Tax Clearance Certificate. It is necessary for several kinds of transactions and acts as proof of compliance with tax responsibilities. By understanding the process and requirements for obtaining a TCC, you may make sure that everything is done smoothly and effectively.